03/15/2022

Grand-parents and kids with parents of different cultures

Have you ever wondered how grand-parents could live a situation of multi-culturality? When your children marry someone from a different culture, that they know nothing about, and when they sometime live very far away? I asked their inputs to the grand-parents of my sone!

An article in 3 parts :

12:51 Posted in Expatriation (in India and in other countries), Little Samourai | Permalink | Comments (0) | Tags: india, france, bandati, third culture, multiculturality, biculturality, grand-parents | ![]() Facebook | |

Facebook | |

09/13/2021

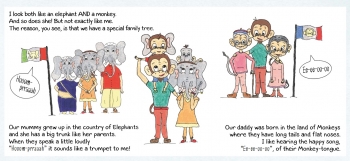

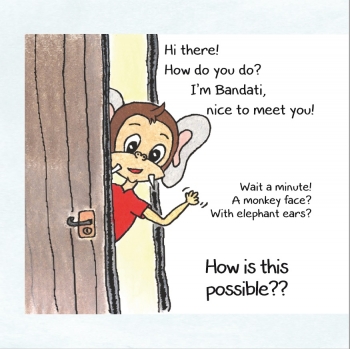

How a little French-Indian boys sees the world...

Since Little Samurai started speaking, I wrote down and collected some of the thoughts he shared, either because they made me laugh or simply because they startled me. Click on this link to have a glimpse of what can happen in the head of a little French-Indian boy who grows up in India…

(And do not hesitate to visit the Bandati page for a book for children (3-7 years) on the mixed / multicultural family, available everywhere.)

08:00 Posted in Expatriation (in India and in other countries), Little Samourai, My stories in India | Permalink | Comments (0) | Tags: india, france, bandati, children book, mixed family, multicultural family | ![]() Facebook | |

Facebook | |

06/08/2021

Finally a book to talk about mixed family to children, Bandati, is out and available everywhere!

17:31 Posted in Expatriation (in India and in other countries), Little Samourai | Permalink | Comments (0) | Tags: india, france, children book, mixed family, bandati | ![]() Facebook | |

Facebook | |