05/29/2017

How to open a bank account in India

There is a plethora of banks in India.

Private local (but good) banks:

- HDFC - I tested

- Axis - I tested

- ICICI

International banks:

- Citibank - I tested

- HSBC

Principle:

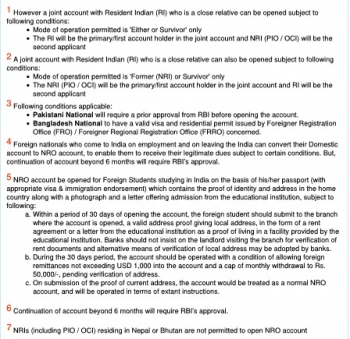

If you travel in India, you can open a NRO (Non-Resident Ordinary) account.

You can deposit money earned abroad in India. The interest earned on this account are taxable in India. You can use this account to make payments in India.

You have to upload documents online (it takes less than an hour) and then it takes 3-4 days for the account to be activated.

Documents for an NRO tourist account:

- Passport

- Tourist visa

- Proof of residence in your country of origin (the Passport is apparently accepted as such, so is the driver license, or a utility bill (electricity or phone) less than 2 months old, a bank statement less than 3 months old)

- PAN Card, which you probably won’t have and in this case the Form 60 (here)

- FATCA / CRS statement (downloadable from the site of the selected bank)

- The CKYC Annexure (downloadable from the site of the selected bank)

- The Bank form

- 2 photos

- All copies self-certified

Transfer funds from your home country to an account in India:

It’s easy.

- You can do this via your home Bank.

- Or WesternUnion.

- Or a Bank in India (ICICI has for example a Money2India module).

- Or PayPal.

- A site of transfer and Moneytis can give you a comparison of all the sites

Repatriate funds from an NRO account to your home country (3):

You can repatriate what’s left on your account within the limit of 1 million dollars a year. Be aware, the account has to be active for a maximum period of 6 months and you must not have put any money earned in India on it (except for the interests) in order to repatriate the balance funds. If you are a tourist and you stay more than 6 months, you will have to ask special permission from the RBI (Reserve Bank of India).

Principle:

If you are coming to study in India, you can open a NRO (Non-Resident Ordinary) student account.

You can deposit money earned in your home country or in India. The interests earned on this account are taxable in India. You can use this account to make payments in India.

You have to upload documents online (it takes less than an hour) and then it takes 3-4 days for the account to be activated.

Rule:

Within 30 days of opening the account, you must deposit at the Bank your address proof in India. Pending verification of address, you can deposit maximum $ 1,000 and withdraw maximum Rs 50,000.

Documents for an NRO account:

- Passport

- Student visa (or tourist visa with admission letter from the Institute)

- Proof of residence in your country of origin (the Passport is apparently accepted as such, so is the driver license, or a utility bill (electricity or phone) less than 2 months old, a bank statement less than 3 months old)

- PAN Card, which you probably won’t have and in this case the Form 60 (here)

- FATCA / CRS statement (downloadable from the site of the selected bank)

- The CKYC Annexure (downloadable from the site of the selected bank)

- The Bank form

- 2 photos

- All copies self-certified

- All signed copies

Transfer funds from the France (or abroad) to an account in India:

It’s easy.

- You can do this via your home Bank.

- Or WesternUnion.

- Or a Bank in India (ICICI has for example a Money2India module).

- Or PayPal.

- A site of transfer and Moneytis can give you a comparison of all the sites

Repatriate funds from an NRO account to your home country (3):

You can repatriate what's left on your account within the limit of 1 million dollars a year. The RBI (Reserve Bank of India) doesn’t mention any maximum duration for the account to be active, but it is reasonable to assume that it is related to the duration of the visa.

EXPATRIATES working in India (employment visa)

EXPATRIATES working in India (employment visa)

It also works for the OCI and non-working foreign residents, I assume.

You can open a Domestic account / Resident, also called a ‘Resident Individuals’ account (which may be a salary account or own account (normal current/saving account)).

Documents to open an account a Resident Individual:

- Passport

- Employment visa (they might also ask for the contract0

- Proof of residency (copy of the FRRO or OCI booklet)

- Proof of address in India

- PAN Card or the Form 60 (here) if you don’t have a PAN Card (though you might apply as you will need it)

- The Bank form

- 2 photos

- All copies self-certified

NB: The bank usually requires you to send the scan of the renewed visa every year to keep the account active. After 12 months without any transaction, the account is considered as inactive – interests continue to run but you can no longer make any transaction. It is however possible to reactivate an inactive account.

Transfer funds from your home country to an account in India:

A priori you won’t need to do it since you will be working. Otherwise the methods given above for tourists and students work!

Repatriate funds from an Indian account to your home account (3):

To repatriate funds, please note that it is highly regulated and that online transfer solutions may not work.

So you may have to go to the Bank and fill out the ‘foreign remittance’ form. You will have to have in hand the details of the account on which you want to transfer the funds (IBAN and SWIFT). You must also provide the evidence of salary (because you cannot transfer more than your net pay after all the deductions and taxes): salary slips signed (covering the amount you want to repatriate, e.g. 3 months if you want to transfer the equivalent of 3 months of net salary), or the Form 16, or a certificate from the employer.

You can also use Western Union or other agents of the same type, but I have never tried.

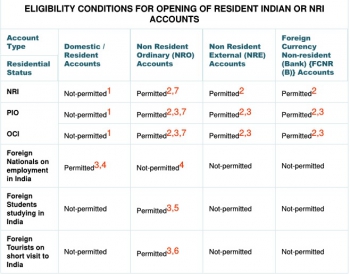

To sum-up what kind of non-resident accounts can be opened in India:

08:00 Posted in Expatriation (in India and in other countries), Travelling (in India!) | Permalink | Comments (0) | Tags: india, bank account, foreigner, student, tourist, expatriate, funds, repatriation, money transfer | ![]() Facebook | |

Facebook | |

01/09/2017

Tourist in India and cash situation / demonetisation

Several people have asked my opinion on how to travel in India right now because of the currency situation, here is my humble advice: come with patience!

Several people have asked my opinion on how to travel in India right now because of the currency situation, here is my humble advice: come with patience!

If you have booked with a tour operator or directly from not-too-bad-hotels, you can pay by card and keep your small change (which is worth gold) to buy a bottle of water, a chai, a rickshaw fare etc.

But since it is still handy to have some cash with you (especially in India), here are some ideas to get rupees:

1. Exchange:

Legally, foreigners are allowed to exchange only 5,000 rupees a week – which is enough pocket money if you pay for lodging, transport (bus/plane/train) and beers by card. Technically, no one can check how much you exchange per week unless you go to the exchange bureau of a chain.

2. ATM:

The other possibility is to withdraw in an ATM, within the limits of 2,500 rupees a day (although apparently the limit has been increased to 4,500). The exercise here is to identify the ATMs that have the cash. The following site can help locating them: https://cashnocash.quikr.com/

3. Bank counter:

There is the option to go directly to the counter at the bank. Here again you must find the Bank that has cahs and it’s not easy easy. Then wait in line. And with a little luck you can withdraw 24,000 rupees (per week, wherever you withdraw, at the counter or the ATM).

4. Indian SIM and apps:

Finally you can take an Indian SIM that will last 3 months. It is not always the easiest experience, but it does get you into the swing... (Apparently in September the Government agreed that all the tourists with an e-visa will automatically receive a SIM card but I can't seem to find out whether it has actually been implemented). You need to come ready with a photocopy of the passport, your visa and a photo. Plan to activate a card with roaming (if you change State) and data to have wifi. And if you get that far and you have previously downloaded the app PAYTM (and recharged your account) you should be able to make a lot of payments with your phone! Uber or Ola app can also be useful.

Good luck!

08:00 Posted in Expatriation (in India and in other countries), Incredible India!, Travelling (in India!) | Permalink | Comments (0) | Tags: india, tourist, tourism, cash, demonetisation, rupees, new notes | ![]() Facebook | |

Facebook | |