07/03/2017

Working in India: Income taxes

After discussing salary, here come the taxes!

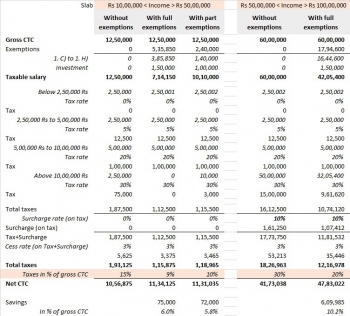

Here is what the Government has in store for 2017-18 income taxes (ouch ouch ouch):

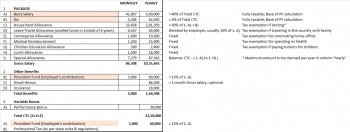

Let's go back to the Foreign guy example, the one who gets 1,00,000 Rs per month or 12,50,000 per year:

Apart from the taxable income, he can get exemptions (amounts that can be removed from the gross salary before calculating taxes), because yes, you can reduce your taxes:

- For the lines 1. C) à 1. H) / the maximum amount to be deducted is indicated in the 'yearly' column

- An amount (deduction under 80C) of maximum 150,000 Rs per year, which includes an investment and/or the Provident Fund (see next post) on the part paid by the employee

So our guy, if he provides proof of maximum amount allowed for exemptions, he will be able to save up to 6% of taxes! Not bad no?! And he will pay 9% taxes even though he falls under the 30% slab! Otherwise, with no exemption, he will pay 15% taxes.

Let's see how in the table below:

In India, taxes are directly deducted from your salary every month. But you still need to fill an 'Income Tax Return'. So if you have paid too much taxes you will get reimbursed (and now it goes amazingly fast) and if you have paid too less you will have to pay. To fill up this return, it is pretty easy and you can even do it yourself by connecting on this website (making sure you got the Form 26 from your employer). It is done yearly, before end of July. And you need to submit the proof at the time of renewing your Employment visa.

If you are not registered it, you can do it here (you only need your PAN number).

And if you don’t have a PAN number, you have to get one if you work in India. You can also do it yourself, and start here.

More info here on taxes: http://economictimes.indiatimes.com/wealth/tax/latest-inc...

08:00 Posted in Expatriation (in India and in other countries) | Permalink | Comments (0) | Tags: india, working in india, salary, income taxes | ![]() Facebook | |

Facebook | |

The comments are closed.