07/10/2017

Working in India: the Provident Fund

If you work in India and you get an Indian salary (I mean you are paid in India and in rupees, not that you get a ‘local’ amount), then you should have heard of the Employees’ Provident Fund Act (1952). The Employees’ Provident Fund, or EPF, or PF, is somewhat a pension system, for which both employee and employer contribute – a certain amount is placed every month (1) and earn interests (2), like a normal investment, and this is called the ‘PF account’ (3). You can withdraw the full amount (the invested amount and interests) (4) when you turn 55 and are retiring.

If you work in India and you get an Indian salary (I mean you are paid in India and in rupees, not that you get a ‘local’ amount), then you should have heard of the Employees’ Provident Fund Act (1952). The Employees’ Provident Fund, or EPF, or PF, is somewhat a pension system, for which both employee and employer contribute – a certain amount is placed every month (1) and earn interests (2), like a normal investment, and this is called the ‘PF account’ (3). You can withdraw the full amount (the invested amount and interests) (4) when you turn 55 and are retiring.

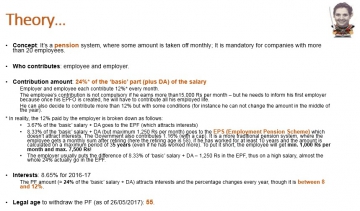

Almost all the companies with more than 20 employees must contribute, for others it is voluntary.

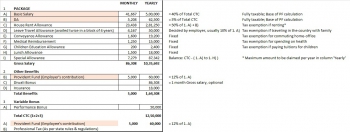

(1) The employer contributes 12% of the gross monthly salary (more precisely on the ‘Basic’ plus ‘DA’ knowing this that the wage structure in India looks like this (See the 1st screenshot at the bottom of the page to understand that the full 12% don't actually go towards the PF):

And the employee contributes 12% as well. That said, the contribution on the part of the employee is voluntary: he/her can decide whether to contribute personally if the salary is greater than Rs 15,000 (if it is less than it is mandatory), and he/her can also contribute more than the recommended amount, with certain conditions.

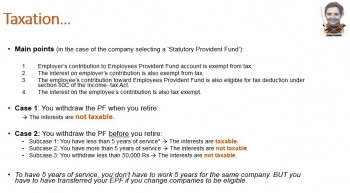

(2) The interest running for the year 2016-17 is 8.65%. It changes from year to year. And these interests are not taxable. The whole EPF (amount and interests) are tax free in fact; though of course it can change.

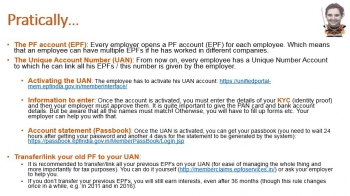

(3) Since 2014, every employee has a UAN, a Unique Access Number, and a single PF account – before that he had one account with each company for which he had worked – and everything can be tracked online. You can also receive a statement which is annual and available around August-October.

(4) If you change company you can transfer your PF by filling a Form 13 and after something magical happens between the old and the new employer, voilà! Or you can also do it directly online.

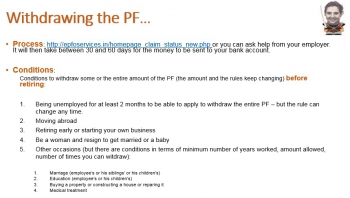

You can also withdraw your PF (though I am not sure if all or only part) but you have to wait 2 months before applying and remain unemployed during these 2 months (except if you move abroad or if you are a woman and you need the funds to get married); after that it takes between 30 and 60 days (or so they say). Please note that if you withdraw funds before retiring, the interests are taxable (unless you have worked for the same employer for more than 5 years).

If you change your job and don’t transfer or withdraw your PF, you will continue to earn interest on it up to 55, even if it’s been more than 3 years since you changed your job (this rule changed in 2016).

If the names and birth dates don’t match exactly on the different PF accounts, bank account and PAN account, well, good luck!!

To sum-up:

Useful links:

- UAN PORATL & UAN ACTIVATION Link: https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- MEMBER PASSBOOK Download Link: https://passbook.epfindia.gov.in/MemberPassBook/Login.jsp

- ONLINE TRANSFER EPF Contribution Link: http://memberclaims.epfoservices.in/

- CLAIM STATUS Information Link: http://epfoservices.in/homepage_claim_status_new.php

08:00 | Permalink | Comments (0) | Tags: india, working in india, pension, provident fund, retirement | ![]() Facebook | |

Facebook | |

The comments are closed.